Lithium Carbonate Hits Rare Price Limit Up! Has Industry Restructuring Concluded?

On July 23rd, the spot price of battery-grade lithium carbonate rose by 2,500 yuan compared to the previous day, with the average price reaching 71,500 yuan per ton; the main futures contract also reached a peak of 74,680 yuan per ton. On July 24th, the main futures contract of lithium carbonate (2509) hit the (maximum price limit) and was quoted at 77,240 yuan per ton,with an increase of 8%.

After nearly a month of continuous upward movement,the price of the main futures contract of lithium carbonate has risen by more than 20% at the stage,and the spot price of lithium carbonate has also increased by about 19%. Moreover,from the forward price curve composed of various futures contracts,the contracts representing the price expectation for the second half of this year have generally risen to above 70,000 yuan per ton,indicating the market's optimistic attitude towards the price trend in the second half of the year.

Under the heavy pressure,the valuation of lithium carbonate is gradually being restored.

01 Valuation Restoration under Heavy Pressure

The price of lithium carbonate has gone from a 14-fold increase to a 90% drop in just two years.

Looking back in 2022,benefiting from the rapid development of the domestic new energy vehicle industry,the price of lithium carbonate rose and eventually reached an astonishing historical high of 600,000 yuan per ton. In the following two years,the price of lithium carbonate rapidly declined with the expansion of production capacity,and has continued to decline for two consecutive years,with the price remaining at about 10% of the peak.

However,the sharp rise and fall of the price of lithium carbonate are not all positive.

In the upstream,major factories such as Tianqi Lithium,Ganfeng Lithium,and Shengxin Lithium Energy have been under continuous pressure on their performance,and small and medium-sized enterprises as well as high-cost enterprises have struggled to survive;in the middle stage,as raw material costs decreased,the profitability of enterprises began to recover,but they also needed to cope with the challenge of inventory impairment;in the downstream,battery factories and car manufacturers have enhanced their bargaining power with the upstream,which may exacerbate the price war at the terminal level.

At this time,the lithium battery industry chain,which was under heavy pressure,happened to encounter the favorable news of industry policy adjustments,and a "restoration riot" regarding the valuation of lithium carbonate began.

First,from the perspective of policy,on July 1st,the Sixth Meeting of the Central Financial and Economic Commission clearly stated:We should deepen the construction of a unified national market,legally and orderly regulate enterprises' low-price disorderly competition,and promote the orderly exit of backward production capacity. On July 14th, the Yichun City Natural Resources Bureau issued the "Notice on Compiling Reserve Verification Reports",requiring 8 lithium mines in the area to compile reserve verification reports and complete the reports by September 30th.

Then,from the perspective of the market,the wholly-owned subsidiary of Zangge Mining,Zangge Potash Fertilizer,received a notice from the Yixi Prefecture Natural Resources Bureau and the Yixi Prefecture Salt Lake Administration,requiring the company to immediately stop illegal mining and actively rectify. Immediately after that,Jiangte Electric Machinery also announced that its subordinate company,Yichun Yinli,to reduce production costs,planned to suspend all lithium salt production lines and conduct equipment maintenance.

The adjustments in policies and the market directly stimulated the market's expectation of supply-side contraction,and the financial attribute of the futures market also amplified the short-term fluctuations. Therefore,even in the context of a decline in the cost center and no unexpected performance in demand,the price of lithium carbonate began to continuously rise. If there is another adjustment in the resource side in the future,this round of price rebound may be more effective and longer-lasting.

Has lithium carbonate reached its bottom?

In fact,the establishment of the bottom of the commodity cycle and the price rebound usually require a substantive reversal in supply and demand relations. Currently,low-cost projects such as South American salt lakes,African lithium mines,and Tibetan salt lakes are the main increments of domestic lithium carbonate,and these projects are less affected by market prices and will not easily adjust,while some high-cost mines have reduced production capacity,but the extent is limited,and the supply has not decreased.

For example,Zimbabwe,as the largest lithium producer in Africa,in the first half of 2025,the export volume of lithium spodumene concentrate from Zimbabwe increased by 30%,reaching 586,197 tons of lithium spodumene concentrate,while the same period last year was only 451,824 tons. Data shows that in June 2025, the total monthly smelting capacity in China reached 134,900 tons, with a monthly growth of 42%. The supply side remains tight, and the increase in demand is insufficient to offset the growth in supply. The overall oversupply situation of lithium carbonate remains unchanged. This means that this rebound has no fundamental support and is likely to be short-lived. When the accumulated risks in the market reach a certain level, industry consolidation will continue.

In the future, lithium carbonate may enter a new stage dominated by cost competition and technological iteration, and industry concentration is expected to further increase.

02 Drives the accelerated reconfiguration of the industrial chain

Although the general trend of this lithium price adjustment is already set, its impact is still spreading, and there are signs of transmission to the downstream, even affecting the purchasing sentiment of the industrial chain.

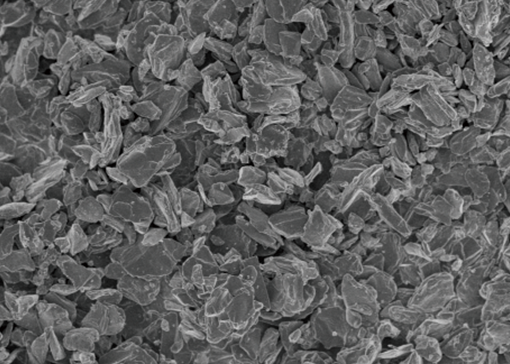

Lithium carbonate is an important raw material for preparing lithium-ion battery positive electrodes, located in the middle of the lithium salt industrial chain, and is a key raw material for producing lithium-ion battery positive electrodes, directly determining the electrochemical performance of the positive electrodes. Usually, battery-grade lithium carbonate is mainly used to prepare cobalt oxide, manganese oxide, ternary materials, and lithium iron phosphate lithium-ion battery positive electrodes.

It is understood that driven by lithium carbonate, the downstream positive electrode materials and lithium battery segments have also started to follow the trend. Industry insiders said that due to the shortage of supply, some energy storage system integrators have received price increase notifications from leading battery cell factories.

Specifically, this follow-up increase mainly occurred in the lithium iron phosphate battery field. And recently, indeed, many battery enterprises have won energy storage battery orders and have been continuously "locking" lithium iron phosphate materials.

In terms of batteries, as the world's leading battery company, CATL, has taken the lead in signing the largest global energy storage project in the United Arab Emirates and decided to establish a regional headquarters there; immediately after that, BYD, as a system party, has again won the Atacama Oasis project and obtained the largest lithium storage supply agreement in Latin America; and Haiden Energy Storage has also cooperated with Jupiter Power, FlexGen, and other system suppliers, with cumulative overseas orders of approximately 30 GWh.

In terms of materials, CATL and Longpan Technology signed an annual purchase agreement at the beginning of the year, including but not limited to lithium iron phosphate positive electrode materials, with a purchase limit of 7 billion yuan; in April, BYD and Fengyuan Co., Ltd. signed a "phosphate iron phosphate cooperation framework agreement", with a contract period of 2025-2028; in May, Chuengen New Energy signed a 500 million yuan sales contract, with an estimated purchase of 150,000 tons of lithium iron phosphate; in the same month, CATL and Wanrun New Energy reached a cooperation agreement, with an estimated total purchase volume of approximately 132.31 million tons from 2025 to 2030.

In summary, the dominant position of the lithium iron phosphate technology route is expected to support the continuous development of the lithium resource industrial chain for a long time. When the demand for lithium iron phosphate batteries in overseas markets continues to increase, it is expected that lithium carbonate will once again enter a price increase cycle in 2026, with the price range moving up to 65,000-85,000 yuan/ton, and lithium battery materials will also return to the price trough, and the industry will start a new round of expansion.

RELATED POSTS

Lithium Carbonate Hits Rare Price Limit Up! Has Industry Restructuring Concluded?