China Dominates Global Mineral Trade

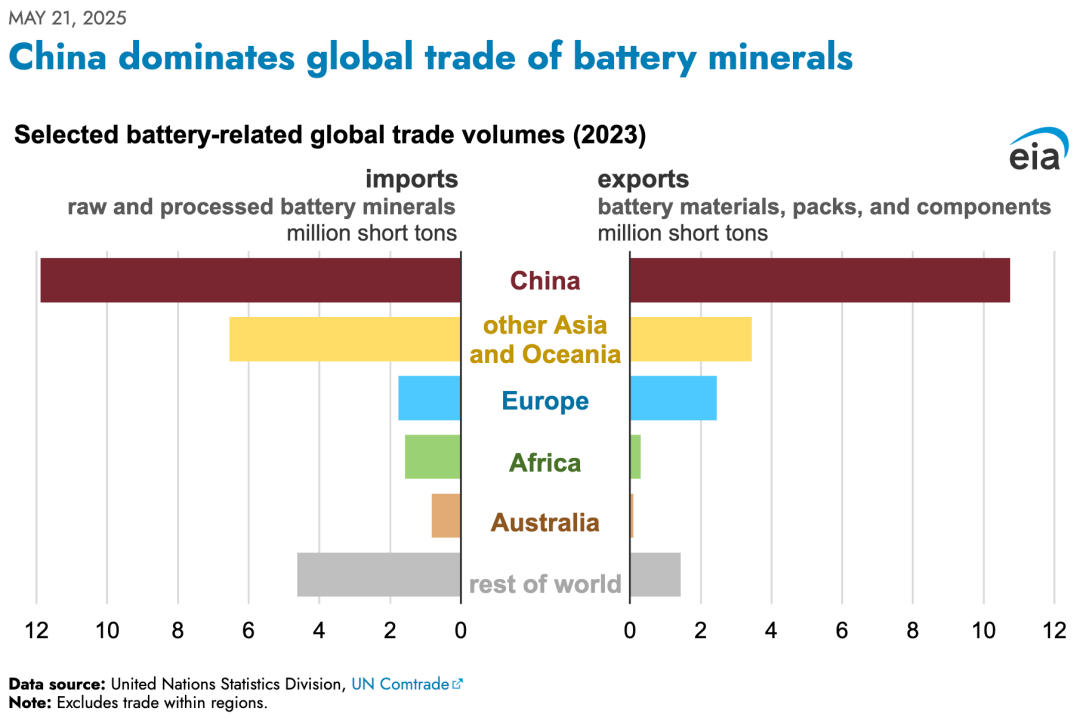

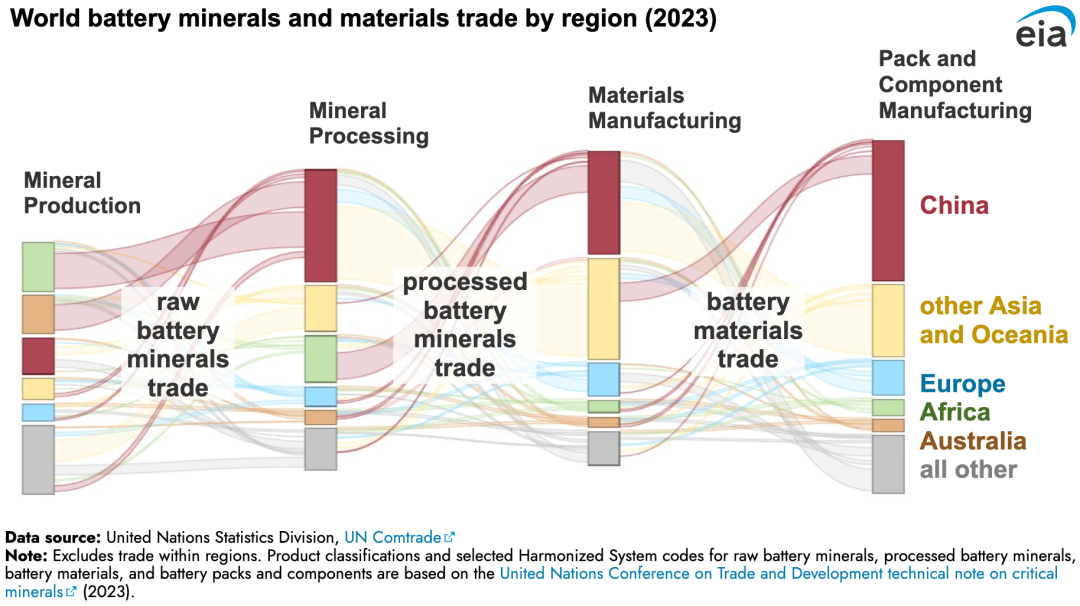

The U.S. Energy Information Administration (EIA) published an article highlighting China's pivotal role in every stage of the global battery supply chain and its dominance in interregional mineral trade.

According to regional data from the UN Comtrade database, in 2023, China imported nearly 12 million short tons (1 short ton ≈ 0.907185 metric tons) of raw and processed battery minerals, accounting for 44% of interregional trade, and exported 11 million short tons of battery materials, packs, and components, representing 58% of interregional trade.

This article examines China's trade of three critical minerals—graphite, lithium, and cobalt—with key global regions. These minerals are mined or extracted from natural and synthetic sources, processed into battery materials, and then used to manufacture battery components, with active trade occurring at every stage. Their importance grows alongside rising global demand for electric vehicles (EVs), energy storage, and other green technologies.

Battery Mineral Production and Raw Mineral Trade

- Lithium: Produced via brine extraction or hard rock mining. In 2023, China domestically produced 18%(33,000 short tons) of the world’s mined lithium, while Chinese companies controlled 25% of global lithium mining capacity. Significant investments in Argentina’s mining projects have granted China access to the "Lithium Triangle" (Argentina, Bolivia, Chile), which holds 50% of the world’s lithium reserves.

- Graphite: In 2024, China produced 79% of the world’s natural graphite (1.27 million short tons), while the U.S. produced none. Chinese firms also dominate synthetic graphite production.

- Cobalt: Chinese companies control 80% of cobalt production in the Democratic Republic of Congo (DRC), where over half of global cobalt is mined.

Raw minerals are transported globally for refining. In 2023, China accounted for 46% of global raw battery mineral imports. Australia, the world’s largest lithium producer, exports nearly all its lithium to China. Collectively, China, Australia, and other Asia-Pacific nations (e.g., India, Japan) represented 71% of global raw mineral imports.

Battery Mineral Processing and Trade

- China processes over 90% of the world’s graphite and more than two-thirds of global cobalt and lithium processing capacity.

- In 2023, China imported 20% of processed battery minerals, primarily cobalt from Africa, and exported 58% of processed minerals, mostly synthetic graphite to Asia and Oceania.

- Starting in 2023, China imposed export restrictions on graphite products for electrode manufacturing, which are expected to reduce graphite exports in 2024–2025.

Battery Material Manufacturing and Component Trade

- Processed minerals are used to produce battery materials. In 2023, China accounted for 53% of global battery material exports. These materials are further used to manufacture components like electrodes, electrolytes, and separators.

- Example: A lithium-ion battery cell typically includes a graphite anode (85% produced in China), a lithium-based cathode (70%), and a lithium salt electrolyte (82%).

In 2023, China dominated 74% of global battery pack and component exports and controlled nearly 85% of global battery production value.

RELATED POSTS

Lithium Carbonate Hits Rare Price Limit Up! Has Industry Restructuring Concluded?